Mobile App for Financial Literacy

Problem

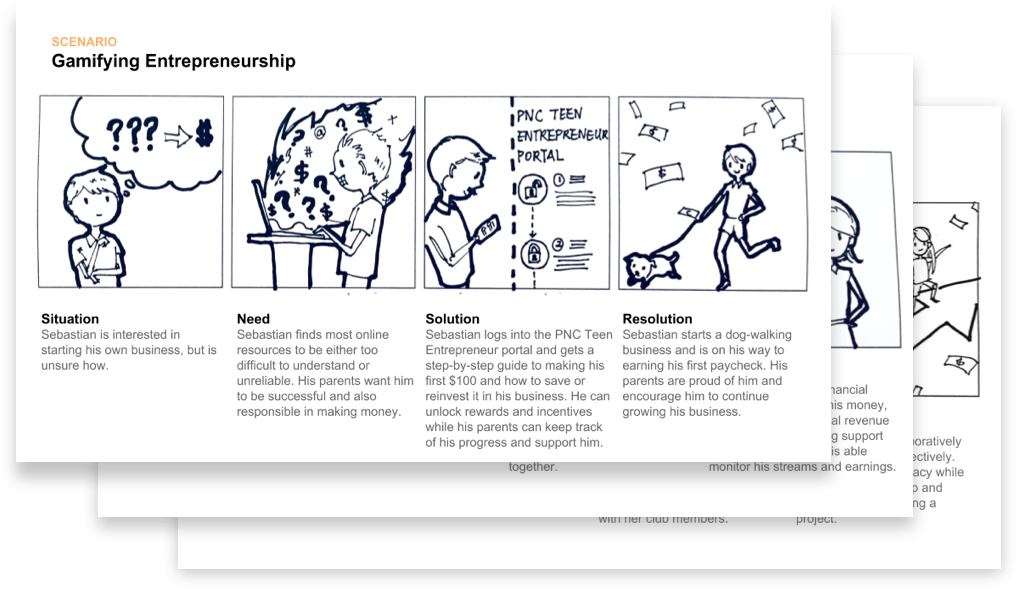

PNC engaged our service design class to develop a service proposition which could both promote financial literacy and establish a valuable relationship with this group of future customers.

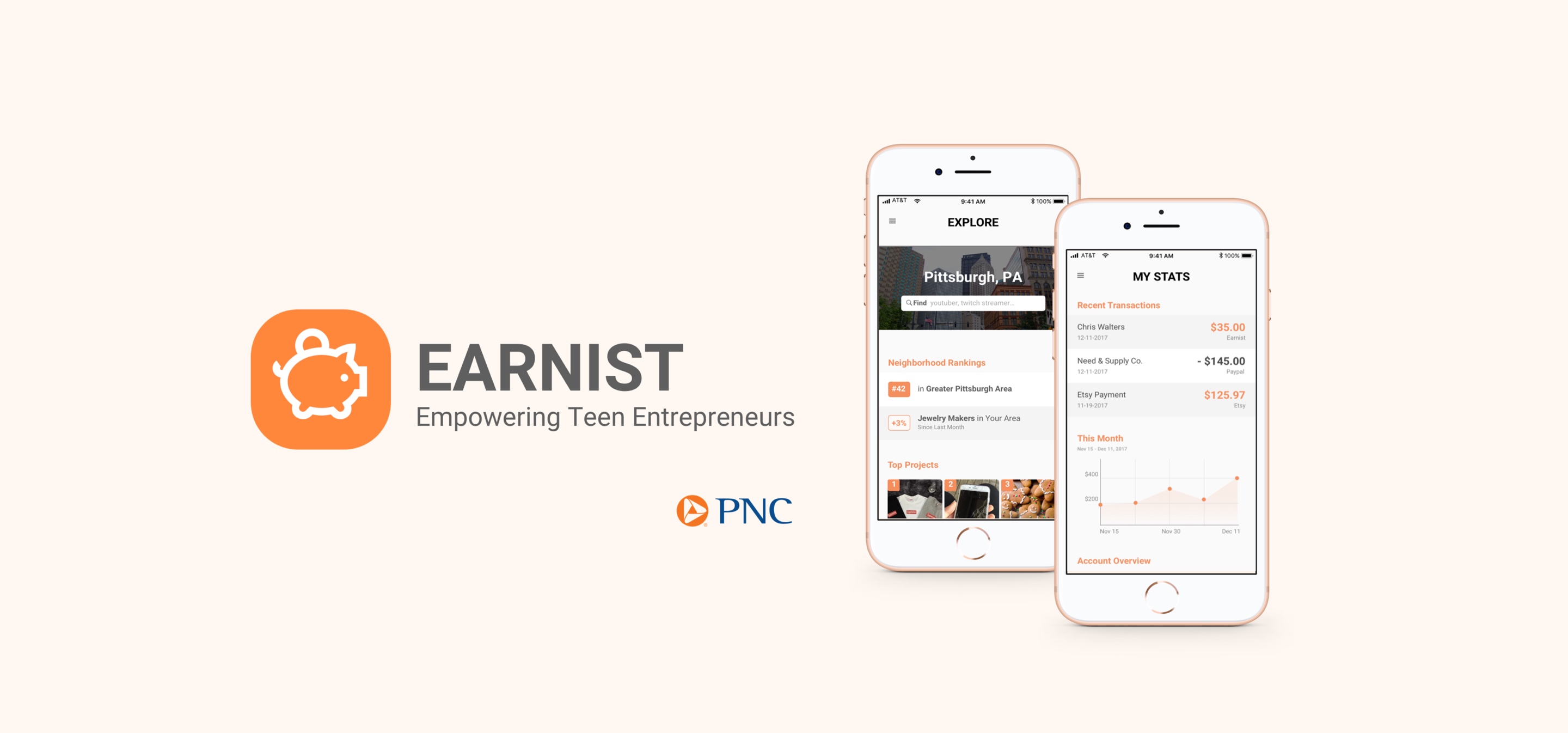

Solution

Our team designed a mobile app concept which empowers teens to explore their entrepreneurial interests and gives parents visibility into the financial activities of their kids.

Background

How does Earnist work?

Our app concept rethinks the functionality behind PNC's existing suite of apps, combining them in novel ways to make it easier for teens to pursue their entrepreneurial interests.

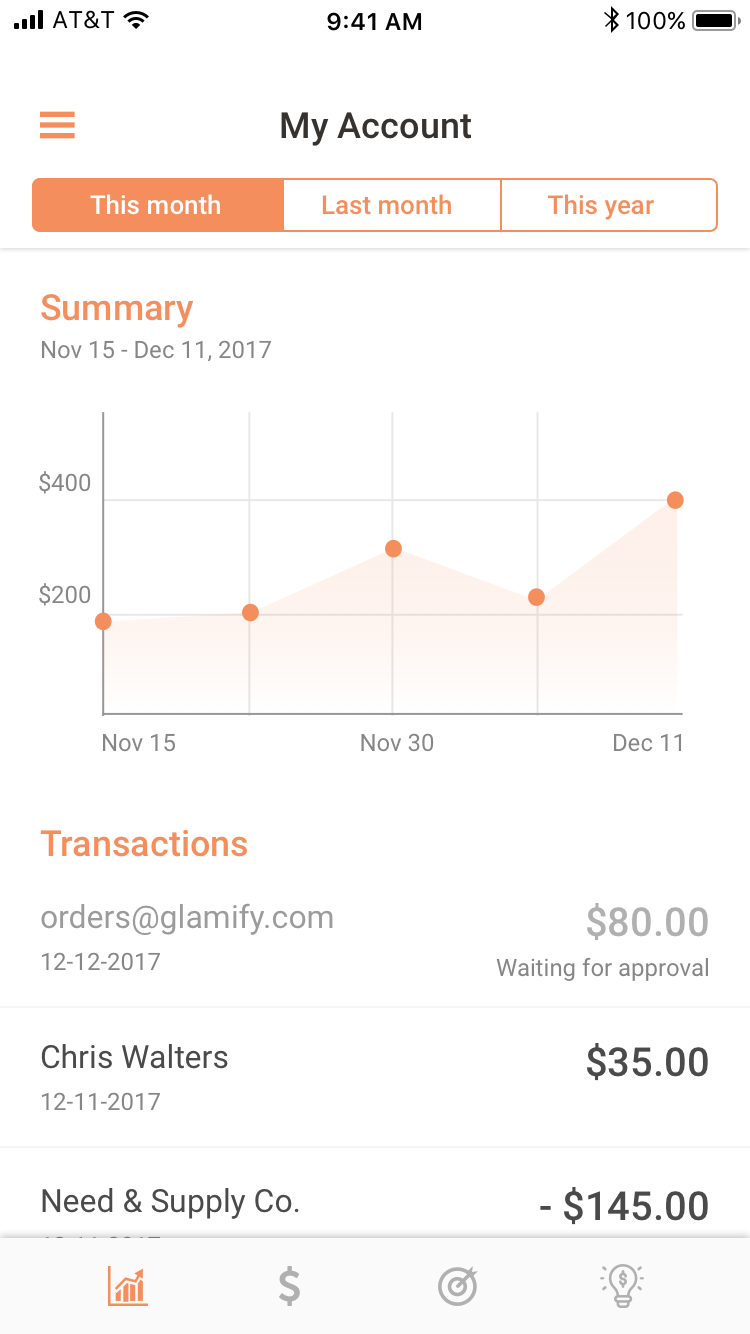

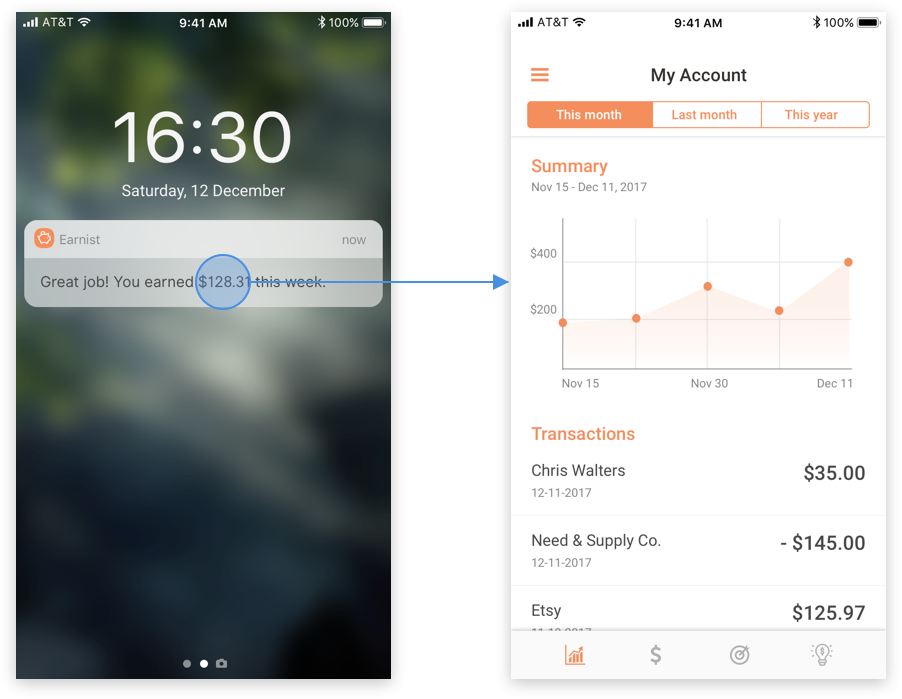

Income and expense tracking

By setting up a teen business account, parents and teens can track income and expenses to gain visibility into how teens are earning and spending money.

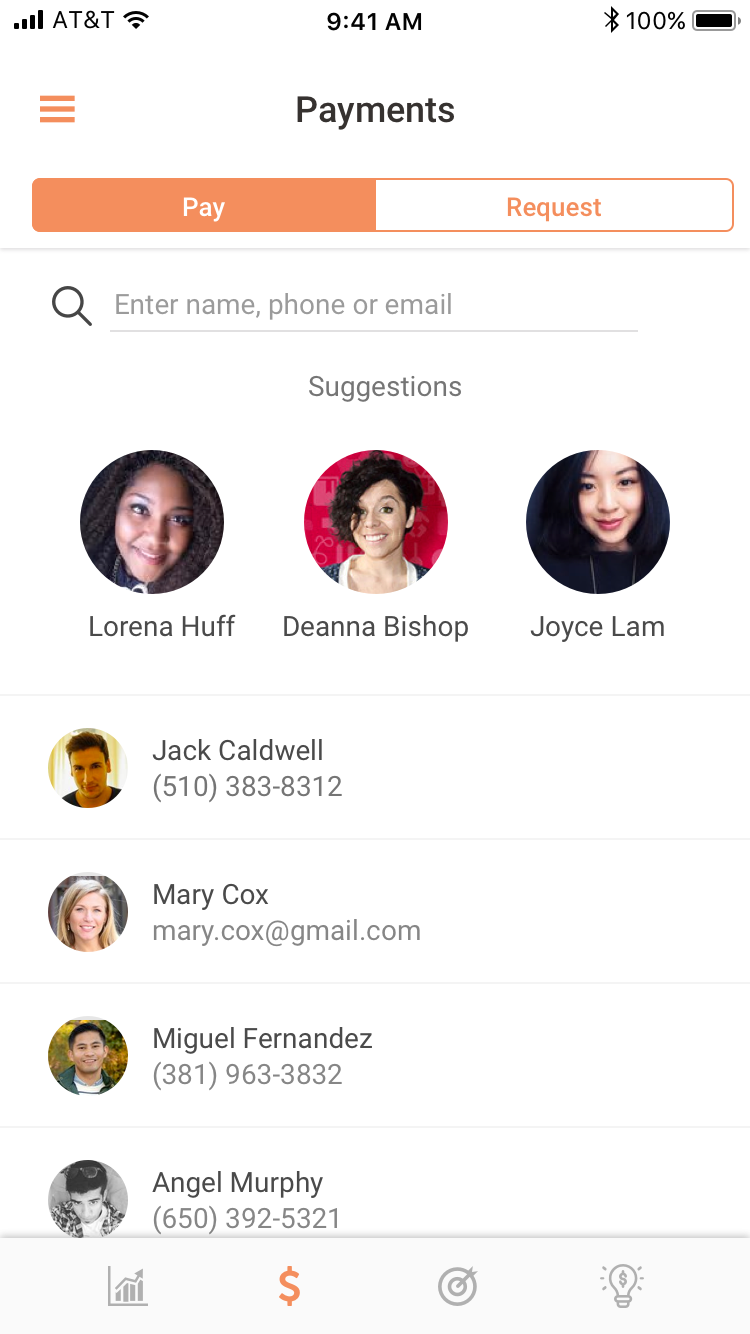

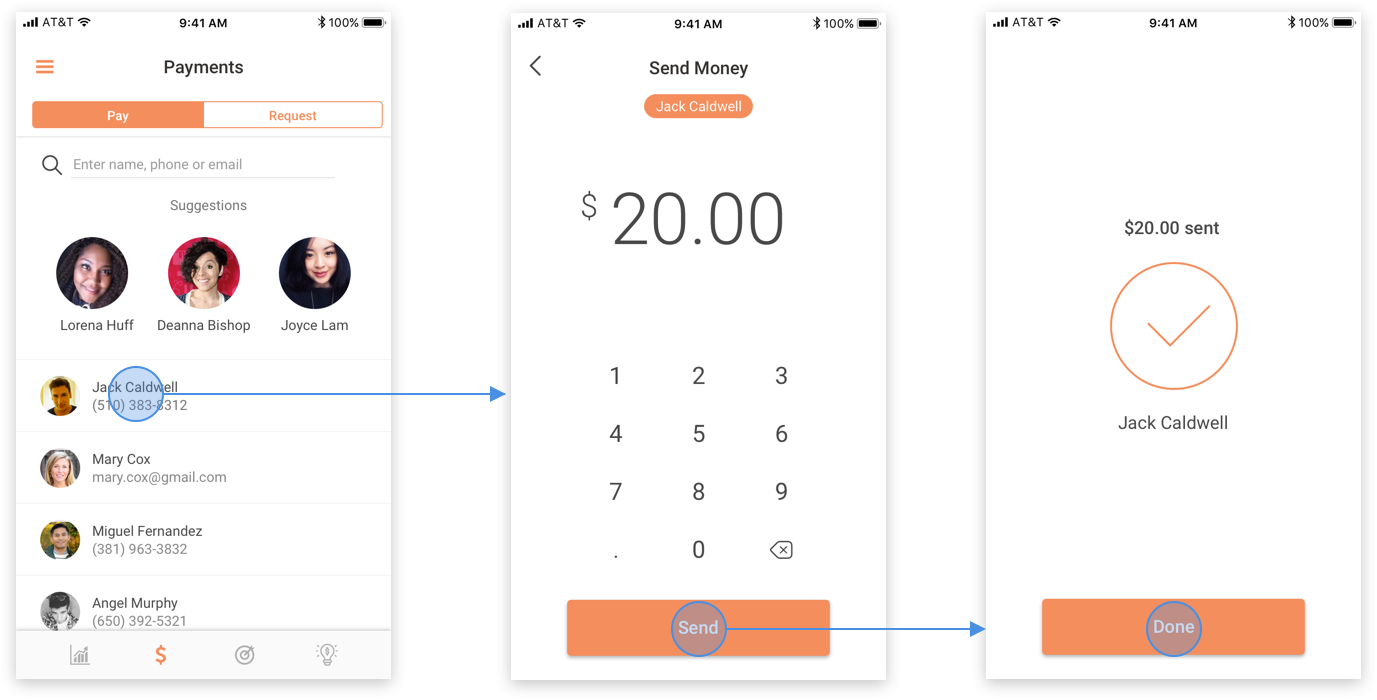

Mobile payments with Zelle®

Teens can use Zelle, PNC’s mobile payment solution, to transact easily and safely for their personal business.

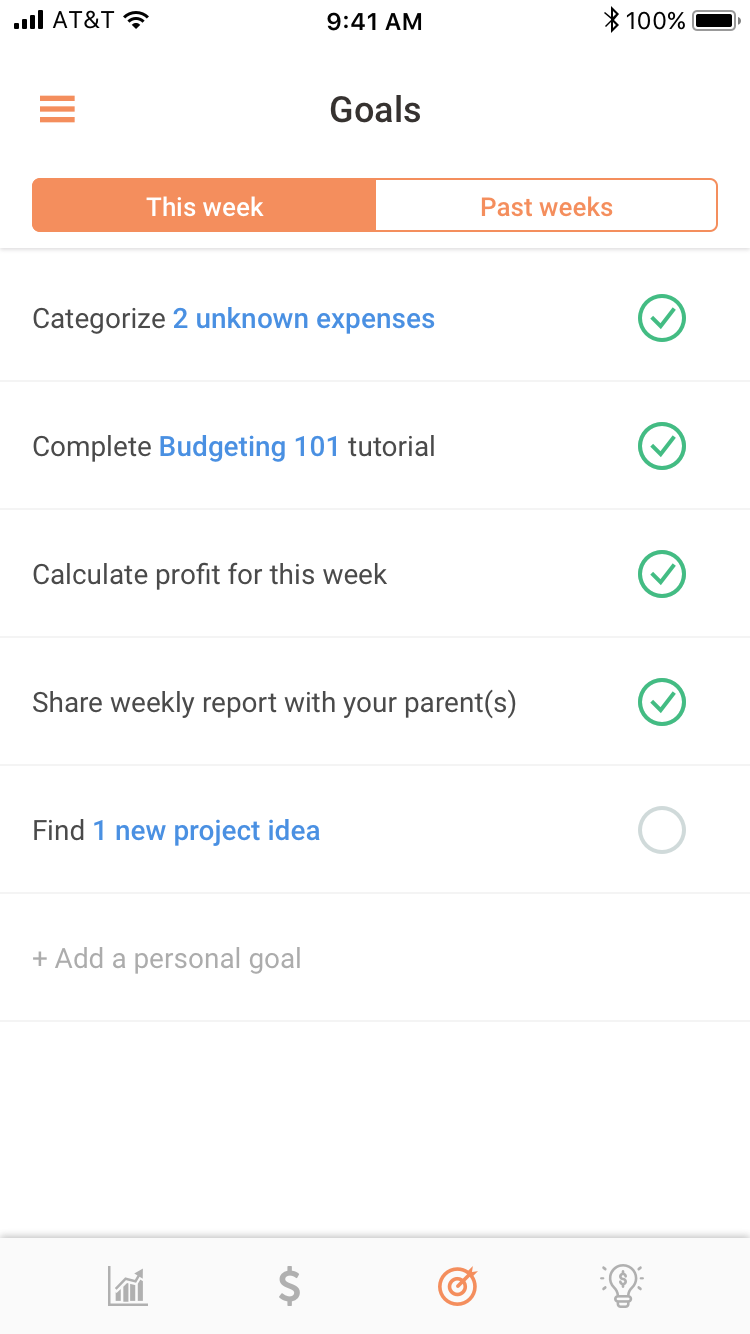

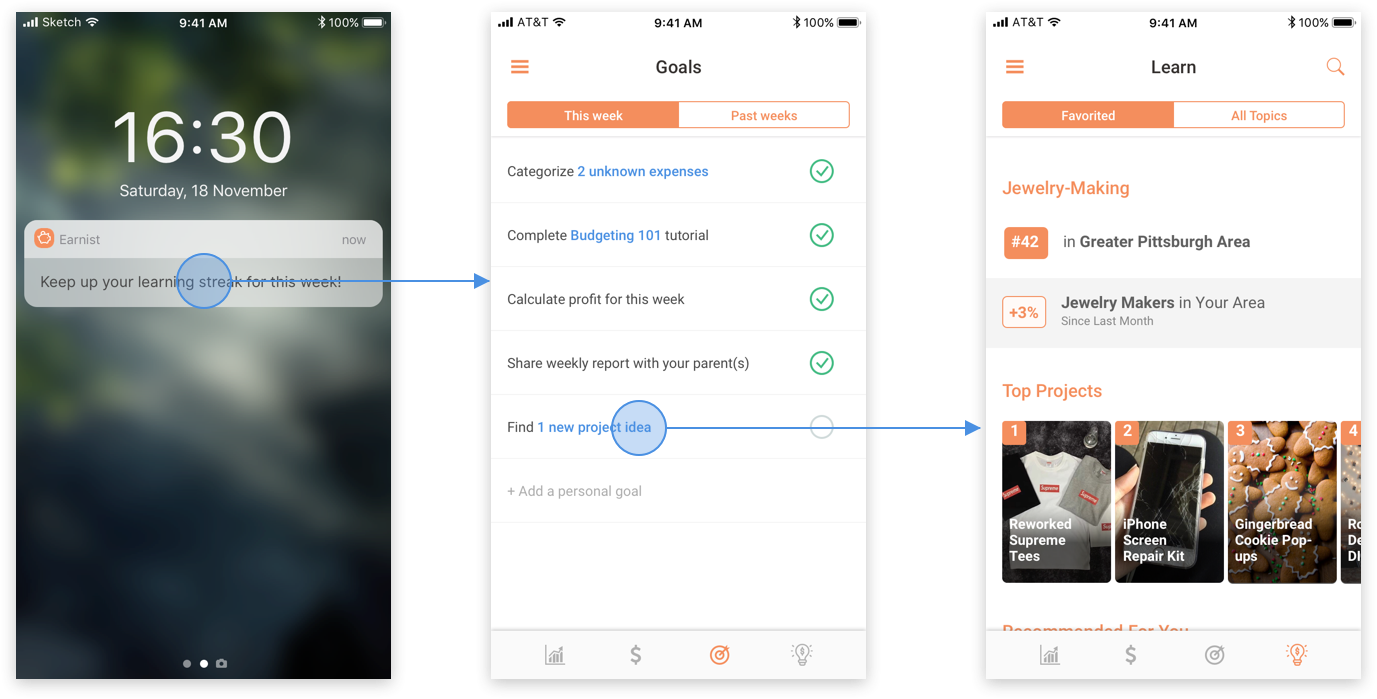

Achieve goals and milestones

Teens can work towards goals and milestones recommended by app, along with their own personal goals.

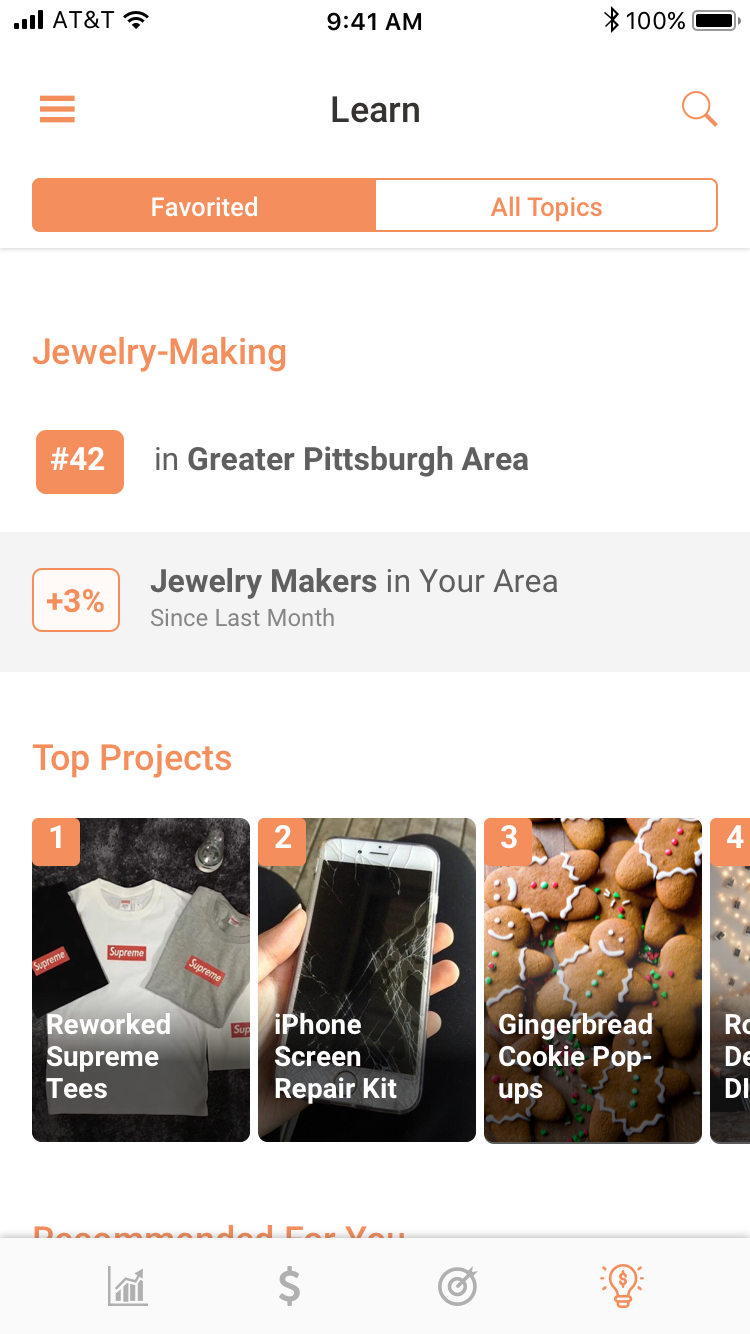

Community-wide analytics

Teens can view community trends and insights using data aggregated across the community.

Research

Finding your inner motivation

I conducted research with my team and the teens we talked to were (surprise!) unfamiliar with most of the concepts that financial literacy experts recommend teens learn in high school.

Still, it wasn't all bad news. Our participants were all interested in making money and becoming financially independent.

So, how might we use this as a motivational hook to learn financial concepts? And how might we integrate these with PNC's product and service offerings?

Parents as partners in learning

Of course, we couldn't forget about parents. It turns out that they were just as interested in having their kids learn financial concepts.

The problem was that they weren't sure how to get started or how to incentivize their kids to do it. Most of them had general goals for their kids, and had some concept of an allowance for good behavior, but nothing which connected the two.

What if we could offer a learning experience that incentivized financial literacy in a way that parents could feel good about?

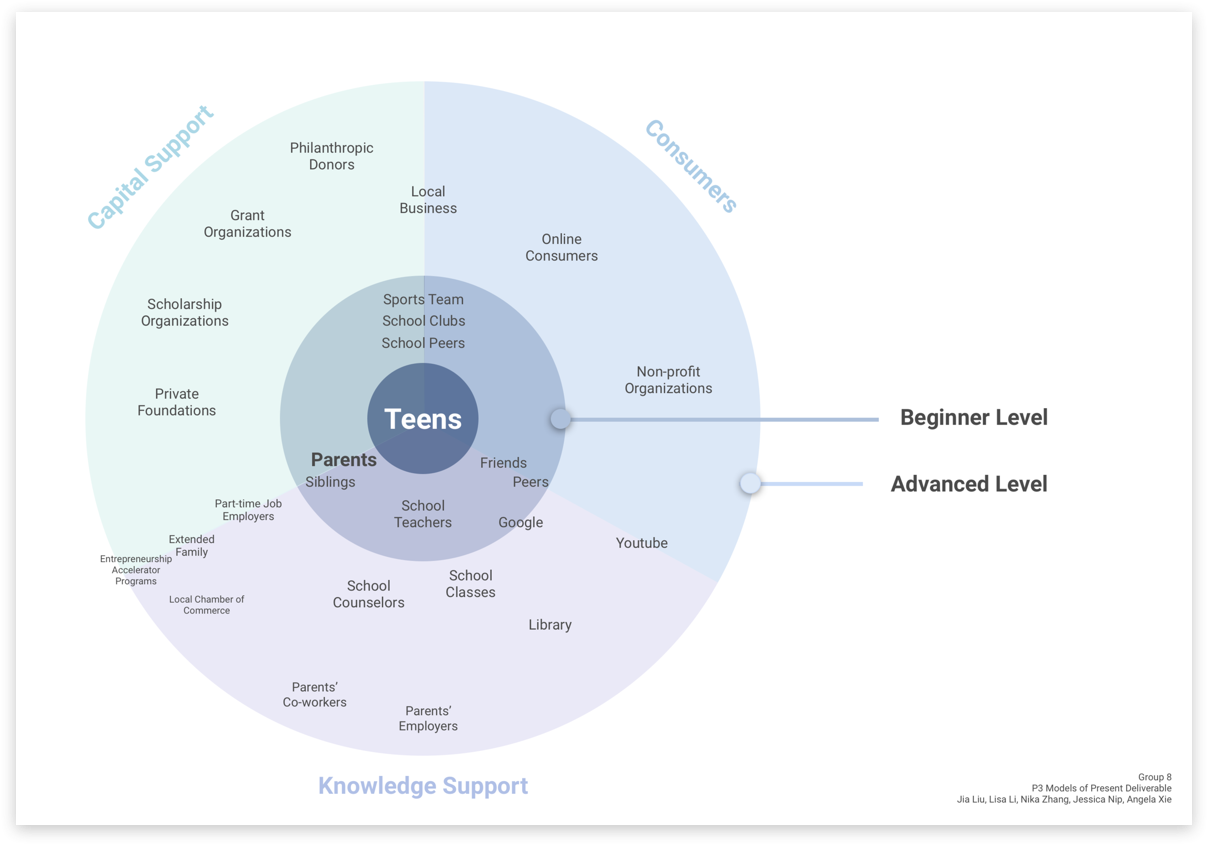

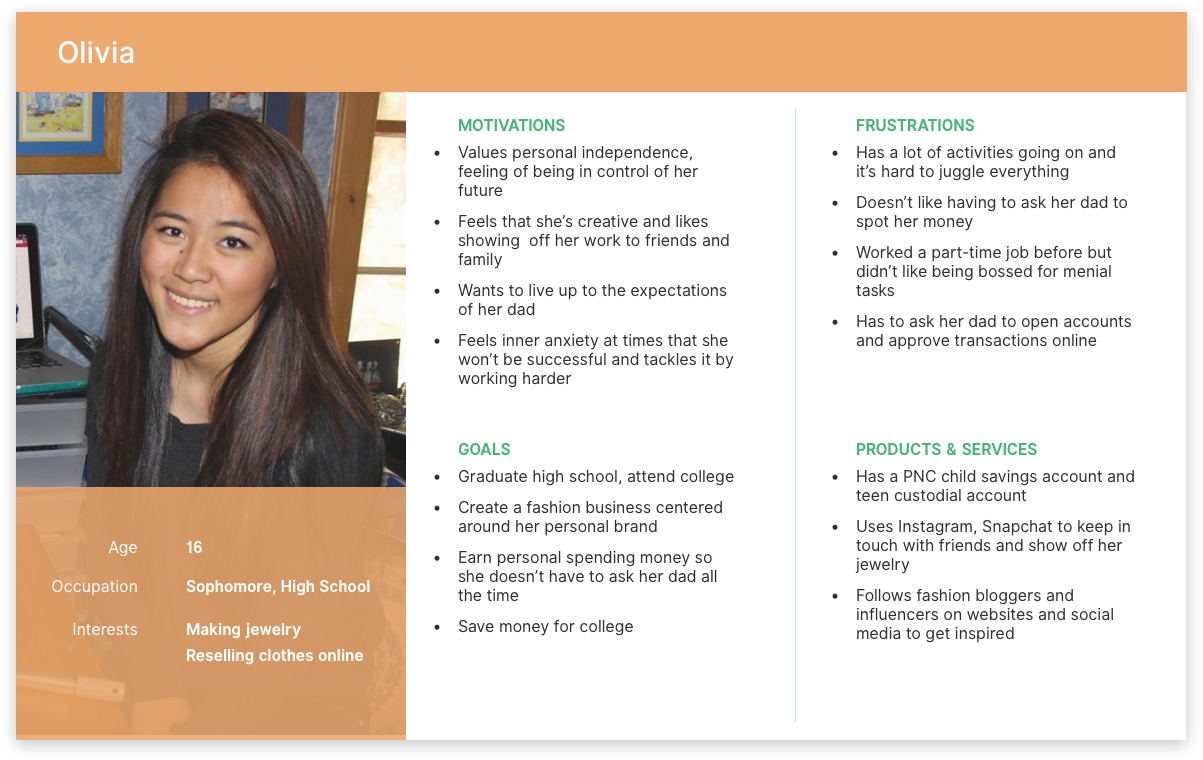

Defining our target user

We constructed a provisional persona based on the teens that we interviewed. Our target user was Olivia, an entrepreneurial teen with a passion for jewelry-making who hadn't formalized her interest in starting a business.

Defining the Problem

We developed our service proposition and features based on a set of specific problems we identified in the course of this research.

Problem 1: Tracking progress

There aren't robust but simple tracking tools specifically for teen entrepreneurs.

Two of the teenagers we interviewed mentioned they had to repeatedly go to their parents to approve transactions or set up accounts. They wished that there was an easier way give their parents visibility without having to constantly communicate with them.

Problem 2: Transacting online

There are lot of friction points to transacting online as a teenager.

The current children's custodial account is focused on saving money, with limited functionality for tracking expenses or setting financial goals.

Problem 3: Learning resources

It can be difficult for teens to find the resources they need for growing a business.

All of the interviewees expressed a strong interest in learning more about financial concepts focused on starting their own business, but learning resources are often focused on more generic financial topics.

Problem 4: Parental controls

Parents want visibility into their childrens' activities.

The parents we spoke with were generally supportive of their childrens' entrepreneurial interests, although they felt strongly there needed to be some safeguards in place to make sure their kids were spending and saving money wisely and weren't entering into unsafe transactions online.

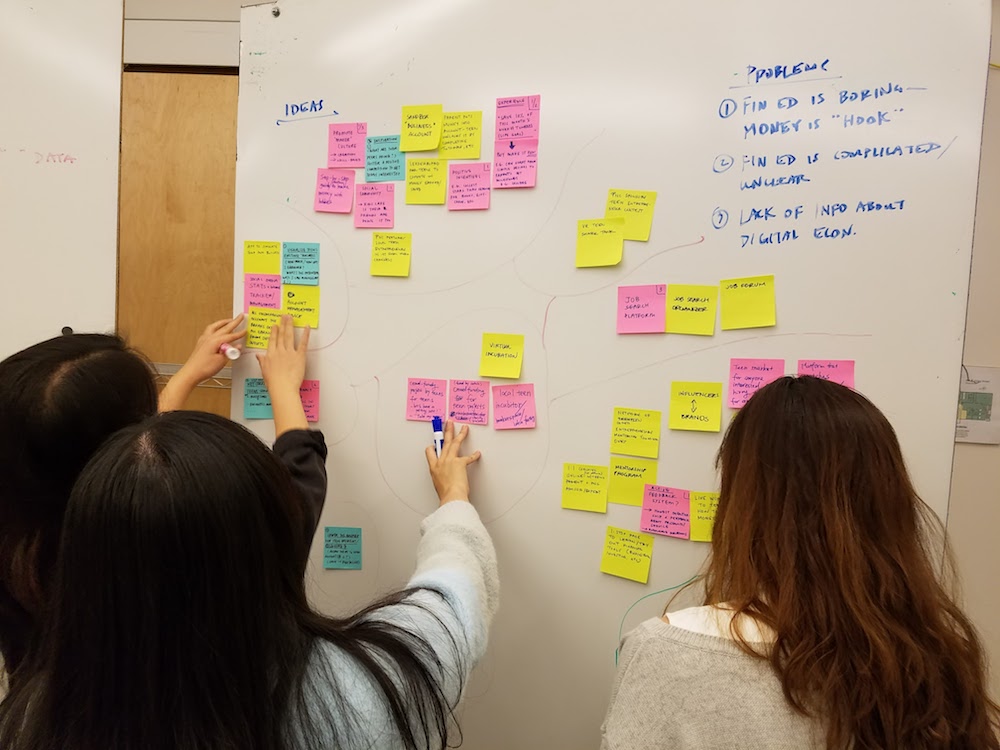

Concept Development

We speed dated 10 concepts to conceptually test different solutions to these problems.

We converged on a mobile app concept which included four features:

- Income and expense tracking by category and source to practice setting and working towards business goals and budgets.

- P2P mobile payments, making it easier to transact online and in-person.

- A learning center with recommended goals and progress tracking.

- Parental controls to approve transactions or pre-approve specific vendors and contacts.

Wireframes

Based on these insights, we developed user flows for several key tasks, supporting the functionality of our app.

Solution 1: Tracking progress

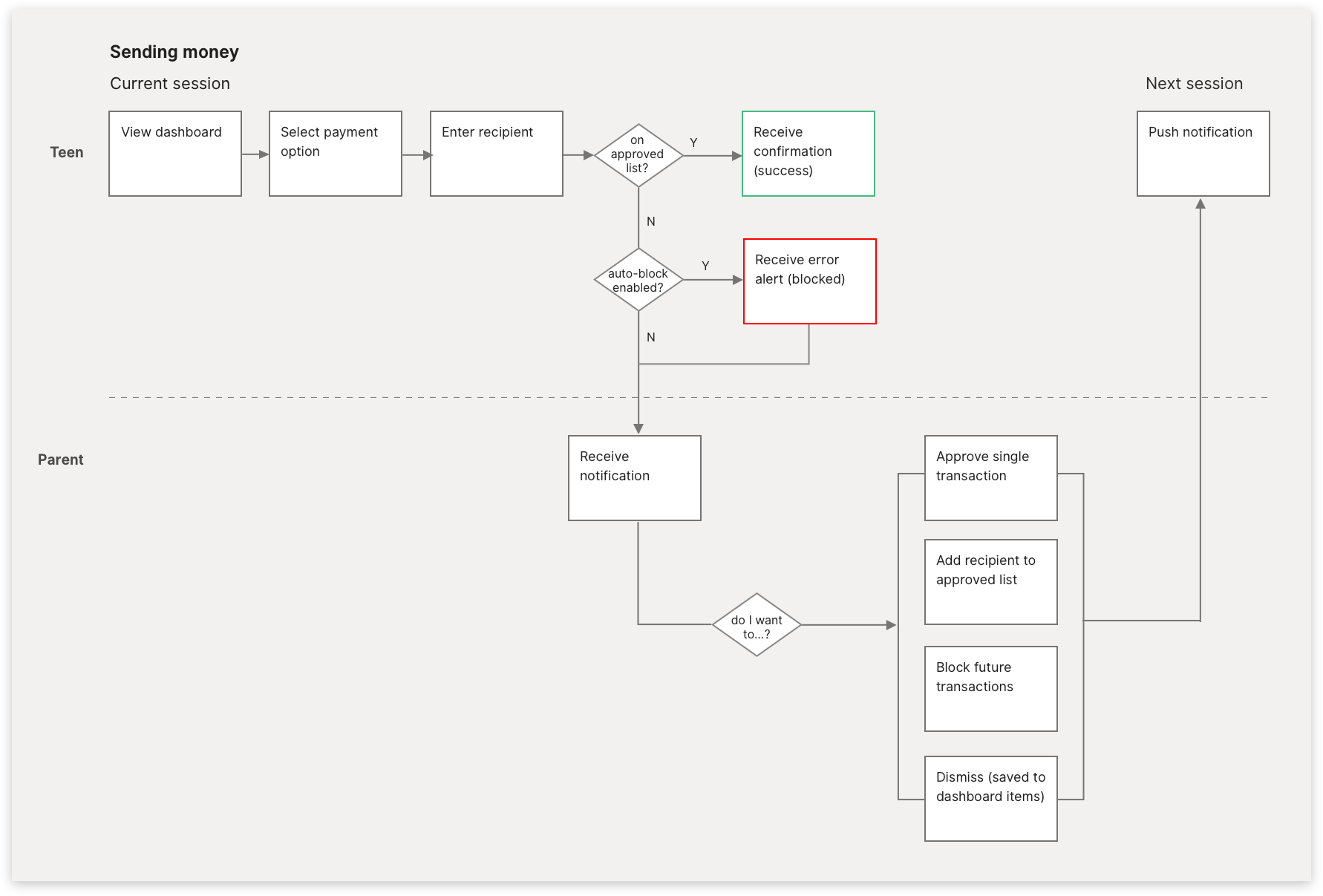

The payment flow was one of the more complicated parts, since there were conditional pathways based on the permissions that the parent had defined.

Solution 2: Transacting online

The payment flow was one of the more complicated parts, since there were conditional pathways based on the permissions that the parent had defined.

Solution 3: Learning resources

The payment flow was one of the more complicated parts, since there were conditional pathways based on the permissions that the parent had defined.

Solution 4: Parent controls

The payment flow was one of the more complicated parts, since there were conditional pathways based on the permissions that the parent had defined.

Specifically, the parents we interviewed had different preferences for how much control they wanted over their childrens' payments. We created the notion of "whitelisting" (i.e. pre-approving) specific payment recipients and one-time approvals to handle these multiple cases.

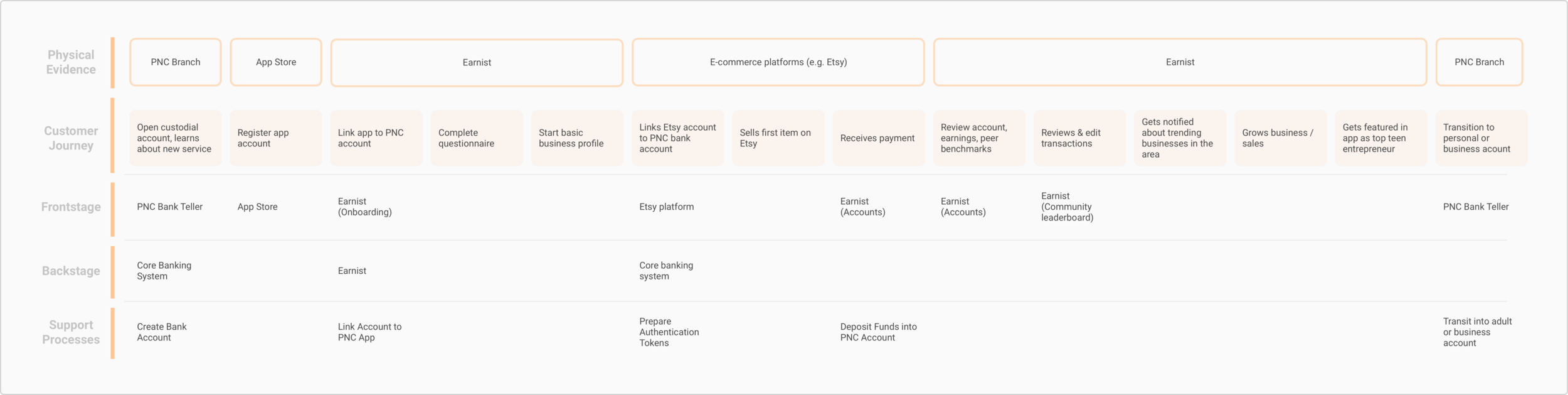

Service Mapping

We developed a service blueprint to map the touchpoints between users and PNC's operations behind the scenes.

Impact and Lessons Learned

Although PNC has always focused on developing products and services for business owners, they hadn't asked how they might serve the next generation of entrepreneurs. In that sense, this project helped them reframe both who they could serve with their financial and educational services and how they might tailor these services to their needs.

Of course, this was also ultimately a relatively brief conceptual design project, so we'd have to take our insights with a grain of salt. For one, we concept tested our design, but didn't test the user experience in an especially robust way. The best we could do was to do was a single think-aloud with one of our teenage interviewees and a round of heuristic evaluation with our classmates. Secondly, one of the hardest parts of designing a service in the real world is getting stakeholders buy-in and solving complex product and organizational issues. Our instructors mercifully peeled away some of this complexity, but having experienced these issues firsthand, I can appreciate the challenge of launching a digital service in the real world.